The number of shares owned by shareholders was adjusted after the market closes on Wednesday, June 21st 2023. An investor that had 100 shares of stock prior to the reverse split would have 10 shares after the split. 55% ORR, 73% DCR, and 7.7 month PFS in DKK1-high/PD-L1-high second-line gastric cancer patients DKN-01 also demonstrated preclinical tumor regression data in CRC models supporting ongoing clinical tri… Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes.

We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

The Wall Street Journal

MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Provides a general description of the business conducted by this company. The Barchart Technical Opinion rating is a 100% Sell with a Strengthening short term outlook on maintaining the current direction.

The average twelve-month price prediction for Leap Therapeutics is $18.80 with a high price target of $30.00 and a low price target of $7.00. Its clinical stage program is DKN-01, a monoclonal antibody that inhibits Dickkopf-related protein 1, or DKK1. DKK1 is a protein that regulates the Wnt signaling pathways and enables tumor cells to proliferate and spread, as well as suppresses the immune system from attacking the tumor. The company is studying DKN-01 in multiple ongoing clinical trials in patients with esophagogastric cancer, gynecologic cancers, or prostate cancer. Leap Therapeutics, Inc. is a clinical stage biopharmaceutical company, which engages in developing novel therapies designed to treat patients with cancer.

Leap Therapeutics started at buy with $18 stock price target at Ladenburg Thalmann

The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Compare

LPTX’s historical performance

against its industry peers and the overall market. Our Quantitative Research team models direct competitors or comparable companies

from a bottom-up perspective to find companies describing their business in a

similar fashion.

The company was founded on January 3, 2011 and is headquartered in Cambridge, MA. According to 4 analysts, the average rating for LPTX stock is “Strong Buy.” The 12-month stock price forecast is $16.38, which is an increase of 859.02% from the latest price. Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

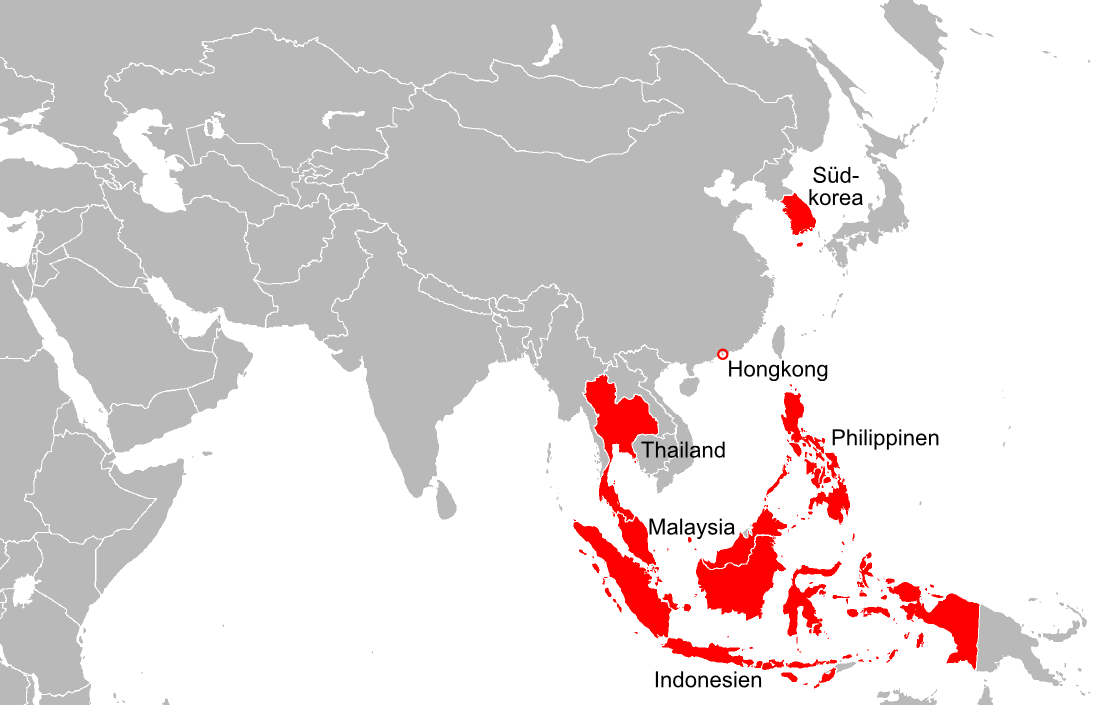

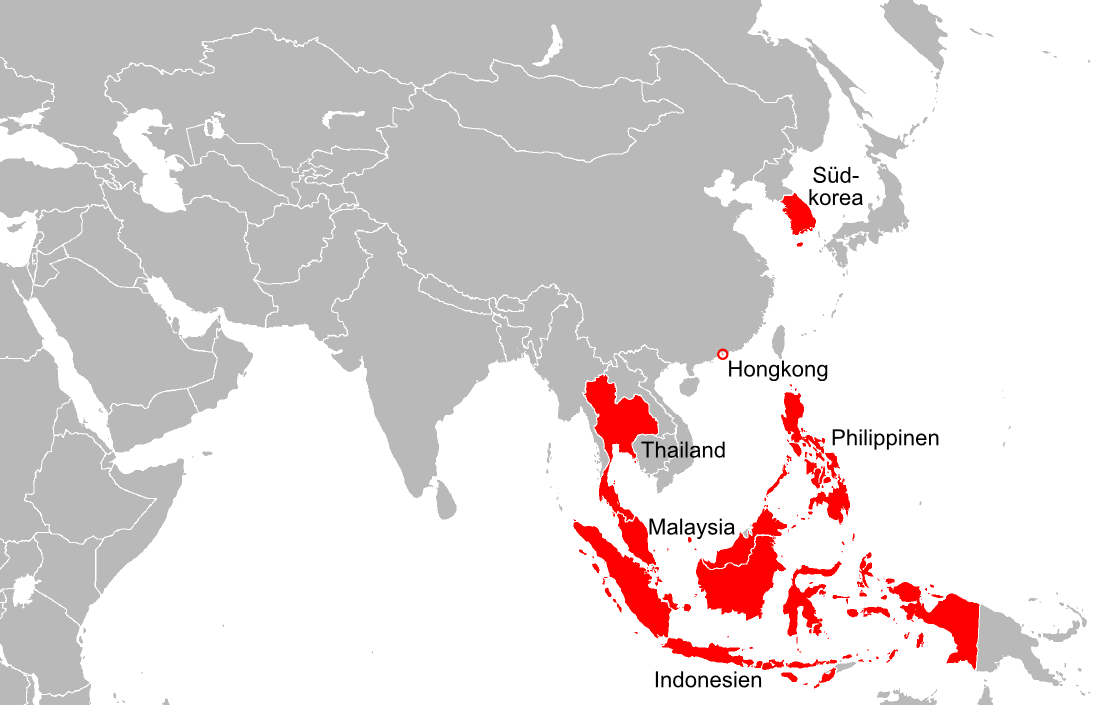

According to analysts, Leap Therapeutics’s stock has a predicted upside of 419.90% based on their 12-month price targets. Leap Therapeutics, Inc., a biopharmaceutical company, acquires and develops antibody therapies for the treatment of cancer. Leap Therapeutics, Inc. has an distress value of property option and license agreement with BeiGene, Ltd. to develop and commercialize DKN-01 in Asia (excluding Japan), Australia, and New Zealand. The company was formerly known as HealthCare Pharmaceuticals, Inc. and changed its name to Leap Therapeutics, Inc. in November 2015.

LPTX Analyst Ratings By Month

The consensus rating for Leap Therapeutics is Buy while the average consensus rating for medical companies is Moderate Buy. Sign-up to receive the latest news https://1investing.in/ and ratings for LPTX and its competitors with MarketBeat’s FREE daily newsletter. One share of LPTX stock can currently be purchased for approximately $1.65.

For example, a price above its moving average is generally considered an upward trend or a buy. High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

4 Wall Street research analysts have issued 1-year target prices for Leap Therapeutics’ shares. On average, they anticipate the company’s stock price to reach $18.80 in the next twelve months. This suggests a possible upside of 1,039.3% from the stock’s current price. View analysts price targets for LPTX or view top-rated stocks among Wall Street analysts.

Leap Therapeutics Announces Appointment of Richard L. Schilsky, MD to its Board of Directors

Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Leap Therapeutics shares reverse split before market open on Wednesday, June 21st 2023.

- Positive clinical trial results are giving investors a reason to cheer.

- Style is an investment factor that has a meaningful impact on investment risk and returns.

- The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

- Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods.

- Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

- Its clinical stage program is DKN-01, a monoclonal antibody that inhibits Dickkopf-related protein 1, or DKK1.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Positive clinical trial results are giving investors a reason to cheer. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. 19.5 months median OS in the overall first-line patient population, exceeding current benchmarks Long-term follow-up identifies additional patient with partial response, resulting in 73% ORR in overal… The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries.

That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Leap Therapeutics Reports Second Quarter 2023 Financial Results – Yahoo Finance

Leap Therapeutics Reports Second Quarter 2023 Financial Results.

Posted: Mon, 14 Aug 2023 07:00:00 GMT [source]

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

Median Progression-Free Survival of 11.3 months in first-line gastric cancer patients treated with DKN-01 plus tislelizumab and CAPOX, exceeding benchmarks in the overall population and in DKK1 and PD… Adds FL-301, clinical stage anti-Claudin18.2 antibody, and two preclinical antibody programs to Leap’s pipeline Combined cash balance of approximately $115 million enhances runway to mid-2025, fully-f… NEW YORK , Jan. 30, 2023 /PRNewswire/ — If you own shares in any of the companies listed above and would like to discuss our investigations or have any questions concerning this notice or your rights…

Is It Time to Buy LPTX? Shares are up today.

Data may be intentionally delayed pursuant to supplier requirements. These two biotech stocks are set to report key clinical data later this year. As an investor, you want to buy stocks with the highest probability of success.

The 7 Hottest Biotech Stocks to Own in 2023 and Beyond – InvestorPlace

The 7 Hottest Biotech Stocks to Own in 2023 and Beyond.

Posted: Sun, 18 Dec 2022 08:00:00 GMT [source]

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.